Best Long Term Care Insurance California Review 2018

We looked at an all-encompassing list of long-term care insurance companies and selected our top v. When making this evaluation, we looked at a variety of factors including how transparent the insurance companies were with information, flexible long-term care insurance plan offerings and customer feedback. Our tiptop five choices for the best long-term care insurance companies are Mutual of Omaha,Transamerica, OneAmerica, National Guardian Life and Lincoln Financial. In this guide, nosotros will give you tips for buying long-term care insurance, answers to frequently asked questions about this type of insurance and detailed evaluations of each of our top company picks.

Superlative Long-term Care Insurance Tips:

- Long-term care insurance policies vary quite a flake, specially by land, so understand what the policy does and does not cover.

- Make a realistic assessment of your needs using an online calculator or long term care specialist, and then your selected plan is not underfunded.

- Always go quotes from multiple companies.

What to Know About Long-term Care Insurance Companies

Sympathise Long-Term Care Insurance Limits

Lesson

Ask questions if y'all don't sympathise plan limits.

Long-term care insurance plan benefits accept limits on how much each policy pays out for various types of services. Some of the critical plan limits you need to know are:

- The maximum amount per 24-hour interval or month the plan volition pay

- How long the policy will pay out

- The policy lifetime maximum

Insurance companies arrive at the lifetime maximum corporeality by multiplying the daily maximum payout by the length of the policy limit. Plans vary widely on the type of care covered. Nether comprehensive plans, care is usually covered upwards to a maximum daily rate for aid in nursing homes, assisted living facilities, developed day intendance centers and retentivity intendance facilities. There may be restrictions on coverage for care received in the senior's home. Skilled nursing care, therapy visits, and activities of daily living assistance are all usually covered under long-term intendance insurance.

Plan for Future Long-term Needs

Taking a wild guess well-nigh how much long-term care coverage you need is a risky way to decide on a policy. The average national monthly cost for dwelling house intendance is over $iv,099 per calendar month and nursing home care is close to $8,000 per month.

Lesson

Be sure your funding level reflects the type of care you expect.

When you buy long-term intendance insurance, you need to choose a funding level. This funding level is the corporeality of money you wait to need to cover your long-term intendance expenses. Before you determine on how many years of funding to purchase, consider your wellness and expected longevity. There are life expectancy calculators available, simply you'll likewise need to think about your future health and family health trends to get a feel for the levels of care you will likely crave down the road. For example, if your family unit has a history of dementia, you lot should probably plan for retention care. Likewise, if your family unit has a history of living for an unusually long time you may want to fix for the extra fourth dimension care may be needed.

You also need to consider how you will probable be living when y'all kickoff using long-term care insurance. Costs and services vary widely depending on whether you alive at dwelling house with aid, in a skilled nursing facility, or in another senior intendance facility. Y'all demand to know where and how you desire to live to ensure in that location is acceptable funding for your later years. For example, help with daily living in your home will generally toll less than full-fourth dimension care in a nursing home. If you wait Medicaid to cover a nursing dwelling house in one case you require full-time nursing care, you could buy enough long-term intendance insurance to cover in-habitation nursing expenses for v years or so before y'all anticipate going into a nursing home.

| Cost of Long-Term Care in the U.S. | ||

|---|---|---|

| Type of Care | Daily Price* | Almanac Cost |

| Adult 24-hour interval Intendance | $68 per 24-hour interval | Varies. $17,000 to $18,000 if attending daily all yr circular. |

| In-Domicile Care or Personal Help | $20.fifty per hour / $164 per day | Varies on number of days per calendar week aid and care is scheduled. |

| Assisted Living Facility | $119 | $43,536 |

| Nursing Home, Shared Room | $225 | $82,128 |

| Nursing Home, Private Room | $253 | $92,376 |

*Figures from Genworth's almanac Cost of Long-Term Care Survey

Programme for Inflation

Lesson

Be sure your long-term care insurance coverage grows with inflation.

I of the good things about long-term care insurance, when compared with life insurance is, different life insurance, information technology provides an inflation benefit. At the time you buy long-term care insurance, $200 a 24-hour interval might pay for the level care you lot expect to need later in life, only volition that be enough when y'all need to use the insurance? How much will care cost many years down the road? Some plans have the option of adding an aggrandizement adjustment to help keep up with inflation. This option increases the daily benefit and policy lifetime maximum each year based on a percentage.

This ways if y'all buy a $300,000 long-term care policy at age 65 with a iii percent aggrandizement option, y'all're looking at a payout of around $500,000 when you hit 85 years old, when you lot are more likely to demand long-term care. A regular life insurance policy would remain at $300,000.

A compound interest choice is preferable to a simple interest, which grows your benefit more slowly. Compare this concept to simple and compound interest in a savings account. Simple interest is but calculated based on the corporeality you deposit into the account. Compound interest, however, is calculated each catamenia based on the sum of deposits plus previously-earned interest.

Know When the Policy Activates

Lesson

Review the plan activation requirements before purchasing a long-term care policy.

The federal government defines activities of daily living (ADLs) to take a standard descriptor for regime and private insurance programs. ADLs include bathing, dressing, transferring (moving from bed to a chair or toilet and back), eating, and incontinence care. Long-term care policies activate if you demand assistance with two out of the 6 standard activities of daily living. This assistance tin exist provided in your habitation or an assisted living setting equally well as a nursing domicile.

Why You Need Long-Term Care Insurance

Insurance is used to defray the cost of possible expenses that could liquidate your savings or have an impact on family unit members' finances. The run a risk of needing care later in life is very loftier, so it's a good idea to consider making long-term care insurance a part of your financial plan to have peace of mind and to be able to receive the level of care you want.

The U.S. Department of Wellness and Human Services released a comprehensive study in 2014 after researching concerns related to long-term health intendance by surveying 15,298 adults aged 40 to lxx years former. The study found that while almost adults do non have a firm understanding of long-term care insurance, they have many concerns with crumbling. Take a chance are, you lot share these concerns, listed below.

| Survey of Long-Term Care Awareness and Planning Aging and Disability Concerns* | |

|---|---|

| Concern | Percentage of Respondents |

| Losing independence | 90.60% |

| Becoming a burden to family unit | 83.50% |

| Losing control of choosing a level of long-term care insurance | 83.thirty% |

| Being unable to depend on family or friends for help or care | 65.30% |

*Findings from the Survey of Long-Term Care Awareness and Planning Research Brief

Our Search for the Best Long-term Care Insurance Companies

1. We searched multiple long-term care insurance companies

2. We evaluated these companies based on our expert-guided ownership criteria: customer experience, programme options, and transparency of information

3. Nosotros provided y'all the best long-term care insurance companies for consideration

The approach we took to narrow downwards the height long-term care insurance companies was as follows:

- We looked at multiple long-term care insurance companies

We began our search with 20 long-term care insurance companies – some familiar and others not and then familiar. We researched each company's products and plans to see what they cover.

- We checked with experts

We analyzed long-term care insurance companies based criteria laid out by the Assistants on Aging. We also looked at things to know before choosing a long-term care policy put out past the U.S. Department of Health and Homo Services.

- Nosotros listened to consumers

We narrowed our listing past using companies that had high ratings on online customer review sites. Nosotros found and removed companies who had a big number of negative reviews.

- We put the best companies on your radar

Our final list of long-term care insurance companies meet the criteria listed above and is a great starting point to base your search when shopping for long-term care insurance.

Long-term Care Insurance Visitor Reviews

While long-term intendance insurance providers take drastically reduced in numbers over the last few years, there are nonetheless many companies providing coverage. Nosotros sorted through the data for y'all. Our in-depth long-term care insurance analysis goes deep into what each company offers to clients along with customer feedback. We and so culled downward the listing based on specific criteria defined by what matters most to consumers. The result was a listing of the top five all-time long-term care insurance companies: Common of Omaha, Transamerica, OneAmerica, National Guardian Life and Lincoln Financial. Each of these companies stood out from the competition.

Mutual of Omaha Long-Term Care Insurance Review

Groovy Policy Discounts |

Mutual of Omaha was founded in 1909, hitting $ane billion in benefits paid to clients in 1958. It has been on the annual Fortune 500 list for over xx years and holds the highest fiscal stability ratings from Moody's, AM Best and Standard & Poor'south.

Common of Omaha Savings

We chose Common of Omaha for its policy discounts which include 15 to 30 pct off your long-term care policy. Nosotros too like its flexible MutualCare long-term insurance solutions which are designed to protect your retirement assets. MutualCare Secure and MutualCare Custom are traditional long-term care insurance options.

MutualCare Secure Solution is a traditional long-term intendance policy offering $one,500 to $10,000 in monthly benefits for a nursing home, assisted living, adult day care and in-habitation care expenses. Information technology is best for those who adopt easy-to-understand benefits and are comfy with a certain level of asset protection.

MutualCare Custom Solution is a traditional long-term care insurance policy that is highly customizable. It is all-time for those who desire to be very specific with long-term care planning.

Types of covered care: in-dwelling house care, assisted living/adult daycare, nursing dwelling house, respite, hospice and medical assist systems.

Policy options available: Innovative inflation protection, nonforfeiture, return of premium up on death, monthly benefit, shared intendance benefit, full restoration of benefits, joint waiver of premium and elimination period credit riders.

The Better Business Agency accredits Mutual of Omaha and gives the visitor an "A+" rating.

To receive a Mutual of Omaha quote, visit their long-term care insurance website or call 877-882-7556.

Read our full Common of Omaha Long-Term Care Insurance review for more details.

Transamerica Long-term Care Insurance Review

Bully Build-Your-Own Policy |

Transamerica serves xiii million customers in the United States with headquarters in Cedar Rapids, Iowa, and employs about 30,000 people worldwide. Transamerica Life Insurance Company holds a license in every state and currently holds $i,018 billion in insurance policies while receiving high financial stability ratings. Aegon, Transamerica's parent company, has a track record spanning over 170 years and a residue sheet with nearly $1 trillion in investments. Transamerica offers several optional benefits to enhance TransCare III Long-Term Care policies, allowing adults of nearly any historic period to fine-tune coverage to best suit their needs.

Transamerica Financial Strength

We like Transamerica for its build-your-own policy which includes a maximum daily benefit of $l-$500 and policy maximum amount ranging from $36,500 to $1,095,000. It also offers over seven riders from which to choose.

Types of covered care include: in-domicile intendance, assisted living/adult daycare, nursing home, respite, hospice and medical help systems.

Policy riders bachelor: nonforfeiture, return of premium up on death, monthly benefit, shared care do good, total resotration of benefits, joint waiver of premium and emptying period credit riders.

Transamerica holds a "B" rating with the Improve Business Bureau and agree an "A" or amend financial strength rating with A.M. Best, Fitch, Moody'due south and Due south&P Global.

To receive a Transamerica quote, visit their long-term care insurance website or call 888-997-4074.

Read our comprehensive Transamerica review for more details.

OneAmerica Hybrid Long-term Care Insurance Review

Groovy Hybrid Policy |

OneAmerica has been providing fiscal services across the U.s. for over 140 years. Seven companies operate under the OneAmerica umbrella, with The State Life Insurance providing nugget-care long-term care insurance and other products to assist manage the cost of long-term care. One advantage OneAmerica offers with Nugget-Care plans is beneficiaries receive a payout if you never need long-term care before you dice. While long-term intendance insurance is still evolving, many policies offer no payout or asset transfer should you die without needing to use your benefits.

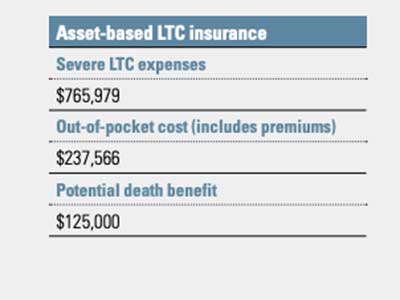

OneAmerica Asset-based LTC insurance

We like OneAmerica for its hybrid nugget-care policies which are based around life insurance or annuities. A hybrid policy based around an annuity can provide you with tax-gratis long-term care benefits.

Types of covered care include: in-home care, nursing care, assisted living, respite, hospice and more than.

Policy riders bachelor: Render of premium, death do good, base policy inflation protection passenger, Asset-Intendance Plus rider, Annuity Care Plus Continuation of Benefits for LTC Option, Annuity Payment Increase choice, refund options, waiver of premium

OneAmerica has a stiff financial forcefulness rating with an "A" or an "A+" ranking from institutions like A.One thousand. Best and Standard and Poor.

To receive a OneAmerica quote, visit their long-term care insurance website or call 888-671-8789.

Bank check out our full OneAmerica review for more details.

Additional Long-term Care Insurance Companies

-

New York Life: New York Life uses a face-to-face consultation with highly-trained insurance professionals instead of finalizing long-term intendance insurance policies online. Read our full New York Life long-term intendance insurance review.

-

GoldenCare: GoldenCare is office of National Independent Brokers, Inc. and is an insurance brokerage firm offer long-term care insurance and other plans from a diversity of insurance providers. In the Western part of the country, GoldenCare operates under the proper name American Independent Marketing. Read our full GoldenCare review.

-

Transamerica: Transamerica Long-term Intendance has helped build more secure futures for more than 571,000 individuals; Paying in excess of $5.7 Billion in claims as of December 2018. Read our total Transamerica review.

Related Long-term Care Insurance Resource

Readers of this Long-term Care Insurance guide also found these related manufactures helpful.

![]()

![]()

![]()

Types of Long-term Care Insurance

If you lot think you'll need assist paying for long-term care during retirement only don't know a lot nigh long-term care insurance policies, read about some of the most mutual types hither.

Long-Term Care Insurance Companies By State

- Washington

Frequently Asked Questions nigh Long-term Care Insurance

Why practise I need long-term care insurance if Medicare covers nursing dwelling care?

Medicare only covers some nursing home costs, usually merely for short-term stays in nursing facilities. Medicare does not pay for assistance with activities of daily living (ADL) care.

Does Medicaid cover nursing domicile care?

Medicaid pays for nursing home care in nigh states, only only after seniors spend down most all avails to fund nursing care. If you transfer assets to another person within five years of applying for Medicaid, yous volition exist ineligible for Medicaid long-term intendance benefits considering your assets could accept been used to pay for the nursing home expenses. For example, if you human action your home to an adult kid a year before you need to go into a nursing home, Medicare can deny coverage until the house is sold and used to pay for intendance.

What should I know about hybrid long-term insurance plans?

Y'all pay for regular long-term care insurance each calendar month or yr, depending on your plan, and the policy remains in effect as long as yous make the payments. With a hybrid policy, your premium payment can exist a "ane and done" deal considering you can link your long-term intendance policy to a paid-up life insurance policy or annuity. Using the linked financial musical instrument, y'all tin can make payments from a single payment up to 20 years depending on the insurance company upfront for your long-term care insurance.

If you do not make an upfront payment for a hybrid plan, yous can elect to pay premiums on a regular ongoing basis, and different regular long-term care insurance, those premiums will never increase. The payments are probable to be higher compared to regular long-term care policy premiums, simply it'due south much easier to upkeep for equal payments.

Another feature of many hybrid long-term care insurance policies is that you lot tin can cull from a diverseness of beneficial features, such as dissimilar do good periods, inflation protection options, and the level of monthly benefit payout.

I of the best features of hybrid long-term care insurance is that you get your premiums refunded if y'all never need to apply your insurance. If you establish beneficiaries, they volition receive a refund of your premiums less any long-term care costs covered over the length of the policy.

Are premiums guaranteed?

Long-term care insurance premiums exercise not change based on individual weather condition between renewal terms. Notwithstanding, long-term intendance insurance providers can heighten premiums on groups of policies merely only after they are granted approving past each state insurance regulator. Ultimately, the insurance visitor must prove the need for a rate increase to each state insurance regulator and only the insurance regulator has the authorisation to corroborate the corporeality of a rate increase and on which groups of policyholders. While many people who purchased LTC policies 5-x+ years ago have seen rate increases, the products sold today have a much lower chance of requiring a rate increment every bit the insurance companies have learned from the past and insurance regulators have become far more restrictive in approving charge per unit increases.

My employer offers long-term care insurance equally a benefit. What happens when I retire or get out my chore?

Companies are not required to continue paying for coverage for you when you lot go out employment. Legally, however, you can take your policy with you after retirement as long equally y'all go along paying for the programme.

Is there a do good limit to long-term intendance insurance?

Yeah, like all insurance, there are policy limits. When shopping for long-term care insurance, know the total limit of funds a policy will pay.

What is the elimination menstruation?

Most long-term care plans include an emptying period of one to three months where you pay out-of-pocket before the policy starts paying for care. The elimination period is similar to deductibles related to health care insurance and are used to ensure that long-term care insurance plans do not pay for curt-term care.

Concluding Thoughts on Long-term Intendance Insurance

Bottom Line:

Take the time to brand sure you're purchasing a long-term care insurance policy that fits your exact needs.

The U.Southward. Section of Health and Man Resource reports that someone turning 65 today has a 70 percent run a risk of needing some form of long-term care during their lifetime. Twenty percent of these people volition need intendance for longer than five years, but Medicare just covers 22 days on average of nursing dwelling care. Medicaid won't begin picking up costs until the senior has used virtually all assets to pay for long-term care expenses, and then care choice is severely limited. With these staggering statistics, planning for long-term care needs is a fiscal necessity.

Best Long-term Care Insurance Companies

| Long-term Care Insurance Visitor | Best For | |

|---|---|---|

| ane | LTC Consumer | Dandy Broker |

| 2 | Common of Omaha | Great Policy Discounts |

| three | OneAmerica | Swell Hybrid Policy |

| 4 | National Guardian Life | Peachy Programme Benefits |

| v | Lincoln Financial | Dandy Policy Protection |

| half-dozen | Nationwide | Cracking Greenbacks Reimbursements |

Source: https://www.retirementliving.com/best-long-term-care-insurance

0 Response to "Best Long Term Care Insurance California Review 2018"

Post a Comment